On December 11, 2016, a specific rule allowing China to be treated as a non-market economy (NME) in the context of dumping and subsidy investigations expired. Since then, the world’s trade defense authorities have been faced with a dilemma: how should investigations, particularly anti-dumping ones, be carried out against Chinese exporters?

The debate arises because dumping investigations involve determining the exporters’ prices and costs in their country of origin (also known as their “normal value”), and comparing this value with their export price. In order to do this, there are specific methodologies set out in the General Agreement on Tariffs and Trade 1994 (GATT 1994) and the WTO Agreement on Implementation of Article VI of the GATT 1994 (the “Anti-Dumping Agreement”).

The Second Addendum to article VI of GATT[1] recognizes, however, that this direct comparison may not be the most appropriate when investigating countries in which there is a complete state monopoly over the investigated industry. Therefore, when investigating countries in which market conditions do not exist, an alternative calculation methodology should be used. The most frequent alternative (although not defined in the multilateral rules[2]) is comparing the investigated exporters’ prices to the exportation price utilized by a third country in exporting to the investigated country[3].

In the specific case of China, article 15 (a) (ii) of the country’s Protocol of Accession to the World Trade Organization (WTO), which determined the conditions for its accession to the WTO, allowed alternative calculation methods to be used, unless Chinese exporters were able to prove that regular market conditions existed in the investigated industry[4]. Thus, the rule was using alternative methodologies. The exception was using cost and price data from the Chinese market, and this was only done in cases in which Chinese exporters were able to show that market conditions existed and justified such an approach, industry by industry (therefore, the burden of proof was placed on the exporters).

This rule of article 15 (a) (ii) is precisely the rule that expired in December 2016, 15 years after the protocol was signed on December 11, 2001, as set forth in item (d) of that same rule. After this, it is no longer possible to assume that China is a non-market economy, unless Chinese exporters are able to prove otherwise. From then on, questions have arisen about how the remaining provisions in the Protocol of Accession should be interpreted, which in turn has led to uncertainty as to which position the WTO members would adopt in trade defense investigations involving China[5].

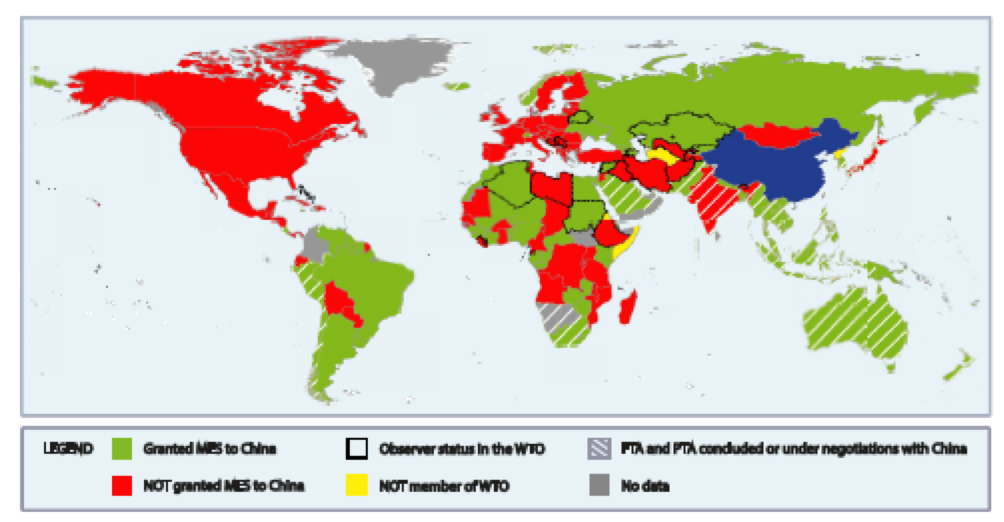

According to the interpretation of article 15 (d)[6] of its Protocol of Accession, the Chinese government understands that the country is granted market economy status once the protocol is 15 years old and that other countries should automatically recognize this status. Other countries disagree with this interpretation, understanding that this status can only be granted by each country individually, according to its own national laws, in order to end China’s NME status[7]. The stance taken by WTO members can be summarized as follows, in a compilation made by the European Parliament in 2015:

WTO Members and whether they granted China market economy status – December 2015[8]

This article will deeper explore the position taken by the United States and by the European Union (which have taken firm positions on the subject), and then describe the position taken by Brazil.

The US has adopted the position that China does not have market economy status, a determination made in accordance with a provision in its internal laws defining non-market economies and setting forth certain factors that must be taken into consideration in assessing a country’s NME status[9]. In the US’s interpretation, the Protocol of Accession indeed allowed countries to assume China’s NME status, a possibility that ceased to exist 15 years after its signature. Nevertheless, this does not invalidate the remaining provisions in article 15, establishing that market economy status will only be granted if the conditions for one, which are set forth in each country’s national laws, are met.

In 2017, in the context of a dumping investigation on imports of aluminum foil from China, the US restated its understanding that China cannot yet be considered a market economy. The Department of Commerce concluded that in spite of recent efforts undertaken by China in order to adopt its economy to market forces, these efforts have not yet been enough to get the country to operate “market principles to permit the use of Chinese prices and costs for purposes of the Department’s antidumping analysis“[10].

On the other hand, the European Union has kept in its internal procedural rules an article[11] which explicitly establishes that China should be treated as a NME, unless Chinese exporters were able to prove otherwise for the particular industry investigated. In December 2016 – one day after its Protocol of Accession completed 15 years, this rule led China to file an inquiry with the EU before the WTO Dispute Settlement Body questioning China’s different treatment when compared to other countries, even after paragraph 15 (a) (ii) of its Protocol of Accession expired[12]. No decision has yet been taken by the WTO Dispute Settlement Body.

Notwithstanding this dispute, in December 2017, the EU changed its procedural rules for calculating the normal value in case of countries whose economies suffer from “significant distortions”[13]. These “significant distortions” were defined in Article 2 (6a) (b) and are similar to those set forth in the US law [14], focusing mainly on state and state-owned enterprises’ influence over the economy (mainly prices and costs), on distortions of wage and financing negotiations, and the equal applicability of laws. After this change, the EU ceased to make a formal distinction between market and non-market economies and removed the provision explicitly stating that China should be granted a different treatment from other countries.

Based on this regulation, the European Commission (responsible for the EU’s trade defense investigations) published a document[15] describing existing distortions in the Chinese economy and concluding that the state exerts a significant amount of influence over the country’s legal, financial, and investment framework. It also identified high levels of government intervention over the country’s distribution and pricing of production factors, both overall and when specific sectors are analyzed (i.e., steel, aluminum, chemical, and ceramic). Thus, the European Union, like the United States, has taken the position that the current conditions of the Chinese economy do not allow the prices and costs of its producers to be considered in trade defense investigations.

Finally, Brazil was listed in the map above as one of the countries that had already granted market economy status to China, even before the Protocol of Accession completed fifteen years. This was a consequence of a memorandum of understandings[16] signed between the two countries in November 2004, at the time of President Hu Jintao’s visit to Brazil. Regardless of the signature of this memorandum, in all dumping investigations and sunset reviews conducted before December 2016, the Brazilian authority calculated normal value for Chinese exporters, based on exports to an alternative third country [17].

On March 26, 2018, Brazil opened its first investigation on imports from China since the country’s Protocol of Accession to the WTO expired in December of 2016, regarding Brazilian importation of rolling mill cylinders. On May 7, 2018, a second investigation began over imports of ductile iron pipes imported from China (and other places). In the documents opening both investigations, the Brazilian authority does not mention the use of exports to an alternative third country to calculate normal value, nor state that China is not a market economy unlike in previous cases. Therefore, based on the public information on the cases available to date, it appears that Brazil will use the prices and costs of Chinese exporters in their own country to conduct the investigation.

There is still no official public statement on the position taken by the Brazilian government. Nonetheless, the memorandum of understanding signed in 2004, considered along with the methodology adopted in these dumping investigations opened in 2018 against importations coming from China, lead to the conclusion that Brazil will treat China as a market economy for trade defense purposes. In spite of this, it will be necessary to monitor the development and final conclusions in these investigations, as well as in other future cases, to reach a definitive conclusion about the Brazilian government’s position.

[1] “It is recognized that special difficulties may exist in determining price comparability for the purposes of paragraph 1, in the case of imports from a country which has a complete or substantially complete monopoly of its trade and where all domestic prices are fixed by the State. Moreover, in such cases, importing contracting parties may find it necessary to take into account the possibility that a strict comparison with domestic prices in such a country may not always be appropriate”.

[2] This methodology was incorporated into Brazilian national legislation, in article 15 of Decree n. 8,058 / 13.

[3] This method was first proposed by Czechoslovakia in 1954 as an amendment to art. VI of the GATT (W.9 / 86 / Rev.1). For more details on the development and consolidation of this method, see THORSTENSEN, Vera. RAMOS, Daniel. MÜLLER, Carolina, O Reconhecimento Da China Como Economia De Mercado: o dilema de 2016. Revista Brasileira de Comércio Exterior, year XXVI, n. 112, Jul / Sep 2012.

[4] Doc. WT / L / 432 (China’s Accession Protocol to the WTO), Article 15.

[5] Some countries had already made earlier recognitions, mainly as a result of bilateral agreement negotiations, granting the status of Market Economy to China (eg Australia). To this end, see: EUROPEAN PARLIAMENT. Granting of market economy status to China. Directorate-General for Parliamentary Research Services. June 2017. Available at: https://publications.europa.eu/en/publication-detail/-/publication/cbc9d72b-b9c0-11e5-8d3c-01aa75ed71a1/language-en

[6] “Once China has established, under the national law of an importing WTO Member that it is a market economy, the provisions of subparagraph (a) shall be terminated, provided that the importing Member’s national law contains market economy criteria as in the date of accession. In any event, the provisions of subparagraph (a)(ii) shall expire 15 years after the date of accession. In addition, should China establish that, pursuant to the national law of the importing WTO Member, market economy conditions prevail in a particular industry or sector, the non-market economy provisions of subparagraph (a) shall no longer apply to that industry or sector.”

[7] It is still fully possible for a country to decide that another country is a NME by following the “general rule” set forth in the Second Addendum to art. VI of the GATT, in case it is concluded that there is, in that country, “a complete or substantial monopoly of its trade and where all domestic prices are fixed by the State”. This rule, however, sets a high and rather strict standard to be met. See i.e., THORSTENSEN, Vera. RAMOS, Daniel. MÜLLER, Carolina, O Reconhecimento Da China Como Economia De Mercado: o dilema de 2016. Revista Brasileira de Comércio Exterior, year XXVI, n. 112, Jul. / Sept. 2012

[8] European Parliament, Granting of market economy status to China. Directorate-General for Parliamentary Research Services. June 2017. Available in: https://publications.europa.eu/en/publication-detail/-/publication/cbc9d72b-b9c0-11e5-8d3c-01aa75ed71a1/language-en. Legend: “MES”: market economy status. “FTA”: free-trade agreement; “PTA”: preferential trading area.”

[9] Section 771 (18) of the Tariff Act of 1930. (B) establishes the factors to be considered in the analysis: “(i) the extent to which the currency of the foreign country is convertible into the currency of other countries; (ii) the extent to which wage rates in the foreign country are determined by free bargaining between labor and management, (iii) the extent to which joint ventures or other investments by firms of other foreign countries are permitted in the foreign country, (iv) the extent of government ownership or control of the means of production, (v) the extent of government control over the allocation of resources and over the price and output decisions of enterprises, and (vi) such other factors as the administering authority considers appropriate.”

[10]Case no. A-570-053, memorandum “China’s Status as a Non-Market Economy”, October 26, 2017, p. 195, free translation. Document available at: <https://enforcement.trade.gov/download/prc-nme-status/prc-nme-review-final-103017.pdf

[11] Regulation (EU) 2016/1036, Article 2(7)(b): “In anti-dumping investigations concerning imports from the People’s Republic of China, Vietnam, Kazakhstan, and any non-market-economy country, which is a member of the WTO at the date of the initiation of the investigation, the normal value shall be determined in accordance with paragraphs 1 to 6, if it is shown, on the basis of properly substantiated claims by one or more producers subject to the investigation and in accordance with the criteria and procedures set out in point (c), that market-economy conditions prevail for this producer or producers, in respect of the manufacture and sale of the like product concerned. When that is not the case, the rules set out under point (a) shall apply”.

[12] Request for Consultations by China – DS516 – European Union – Measures Related to Price Comparison Methodologies (Doc. G/ADP/D116/1 ; G/L/1170 ; WT/DS516/1)

[13] Regulation (EU) 2017/2321, December 12, 2017.

[14] The conditions are as follows: (1) — the market in question being served to a significant extent by enterprises which operate under the ownership, control, or policy supervision or guidance of the authorities of the exporting country; (2) state presence in firms allowing the state to interfere with respect to prices or costs; (3) public policies or measures discriminating in favor of domestic suppliers or otherwise influencing free market forces; (4) the lack, discriminatory application, or inadequate enforcement of bankruptcy, corporate, or property laws; (5) wage costs being distorted; (6) access to finance granted by institutions which implement public policy objectives or otherwise not acting independently of the state.

[15] “Commission Staff Working Document on Significant Distortions in the Economy of The People’s Republic Of China for the Purposes of Trade Defence Investigations”. Brussels, December 20, 2017, SWD (2017) 483 final/2.

[16] In Portuguese, it is called the “Memorando de Entendimento sobre Cooperação em Matéria de Comércio e Investimento”.

[17] The last of these investigations was closed in January 2018 (hot-rolled).